In just a few months, Binance has experienced explosive growth, overtaking its rivals to rank among the top three cryptocurrency exchanges in the world by trading volume. Without a doubt, Binance is now among the best sites for trading alt-coins like Ripple (XRP), Stellar (XLM), and NEM (XEM) to name a few.

As with anything that involves trading with real money, it's extremely important for you to understand Binance's terms and get a clear picture of what you're getting yourself into before you start buying and selling cryptocurrencies. Though its user agreement may be easy enough to understand through careful reading, the fees charged by Binance for trading and withdrawing can be a little confusing.

In addition to that, there are other important aspects to be aware of, such as regulations outside of Binance's control, as well as imposed limitations that are not covered by the user agreement. So we'll delve into it a little deeper to make it easier to understand and show you all the important details you need to know before opening a Binance account on your smartphone.

Binance Is Based Overseas with No Central Location

Though originally based in Hong Kong (an administrative region of China), Binance's CEO, Changpeng Zhao, has since moved his business to multiple locations that he won't fully disclose for security purposes. According to Mr. Zhao:

In response to China's decisions, we are moving our IPs from Hong Kong to an offshore location. Now we have our IPs registered in BVI (British Virgin Islands) and other locations. So we are registered in multiple locations and we have people in multiple locations. That way we will never be affected by one regulatory body.

The move is in no doubt influenced by China's unclear stance regarding cryptocurrencies and exchanges that seem to be a subject of crackdowns on a regular basis. Though highly lucrative, the Chinese government is wary of the technology, which they argue provides a way for its citizens to skirt their tightly regulated currency to move money outside the country.

The App Is Available for Both Android & iOS

So far, Binance is the only major exchange to offer mobile apps for both Android and iOS. Binance is free to install, so head on over to either the iOS App or Google Play Store, or tap on the links provided below.

For iPhone users in particular, it's worth noting that Binance has had a history of being removed form the App Store — either by Apple or by Binance themselves. So don't be surprised if it disappears from the iOS App Store yet again. That said, Binance has stated that the current version is its latest stable release, so grab it now while it's still available.

If it gets taken off the App Store again, or if you don't mind dealing with some potential bugs in order to experience the latest that Binance has to offer, you always have the option of downloading the beta version instead. We have guide on installing the beta iOS app directly from Binance, so check it out below.

Dollars Are Not Accepted

Binance only supports cryptocurrency deposits and withdrawals on their exchange — this means you can't transfer fiat currency like USD or EUR in and out of Binance. So to use the app, you'll first have to buy BTC, LTC, or ETH using an app like Coinbase (or any other service that accepts traditional money), then transfer your newly acquired digital coin to Binance and start trading for alt-coins.

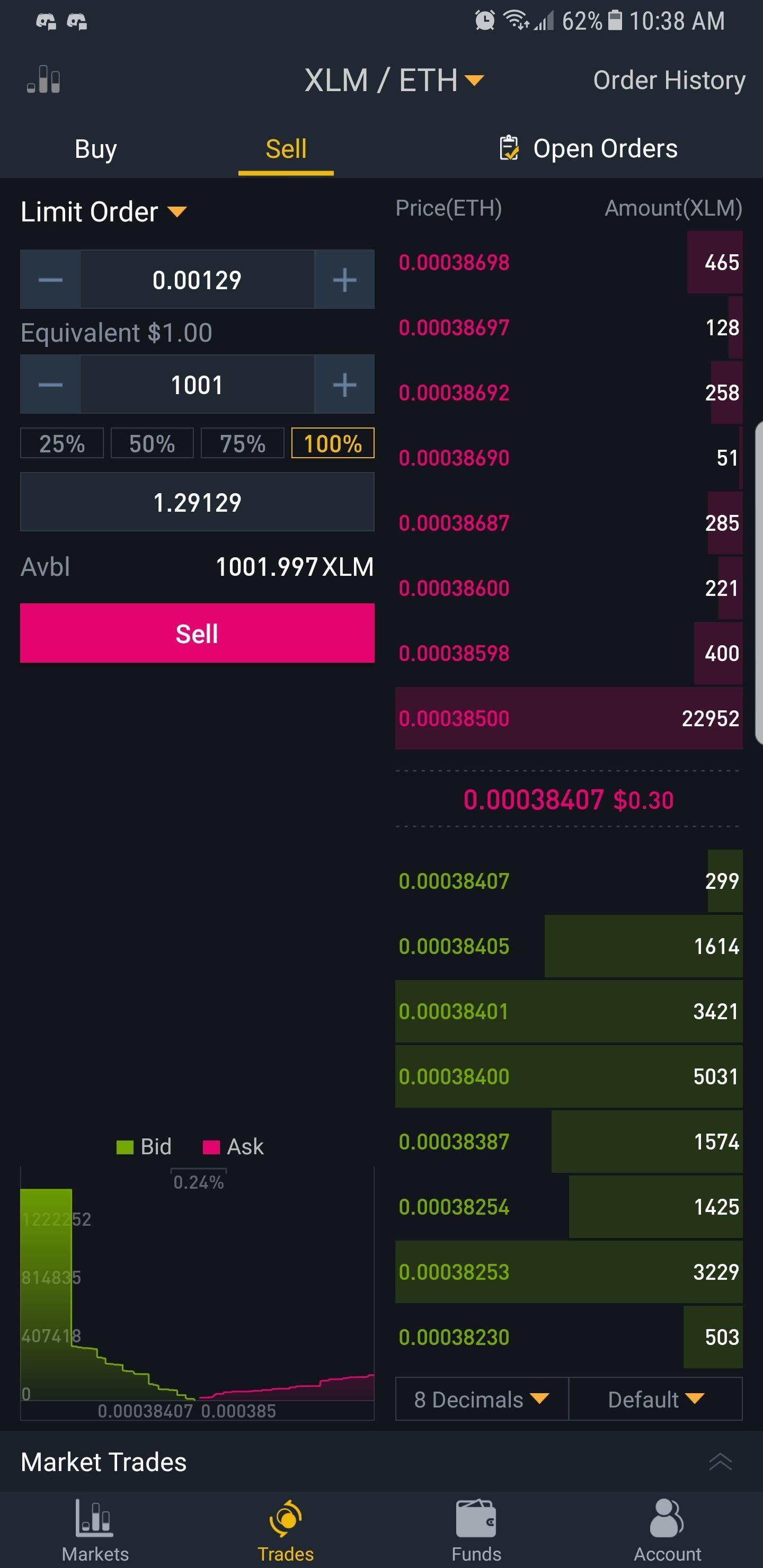

There Are Different Types of Buy & Sell Orders

Binance makes trading cryptocurrency on your iPhone or Android relatively hassle-free, though it falls on you to do your research on your target alt-coin in order to minimize losses. There are two main ways to buy and sell digital coins within the app, namely limit and market orders.

In a nutshell, limit orders let you buy or sell alt-coins at a specific price, which is then placed on the books until the order is fulfilled. For example, if you have 1,000 XLM and wish to sell them off once they reach $1 apiece, you would place a sell order for your XLM at that price, which will then be placed as an open order that you can view anytime by tapping on "Open Orders." Once XLM reaches your target price, the 1,000 XLM sell order you placed will be automatically processed and sold off. Due to market fluctuations, limit orders can take time to be fulfilled.

Market orders are much simpler to execute and allow you to instantly buy or sell cryptocurrencies at their current price by tapping on either "Buy" or "Sell" after entering the desired amount. The main disadvantage of this method is the inherent risk of missing out on opportunities. For example, if you decide to pull the trigger and sell off 1 BCC at the market rate of $1,500 a coin, but the price continues to rise and eventually peaks at $2,000, you would've missed out on an extra $500.

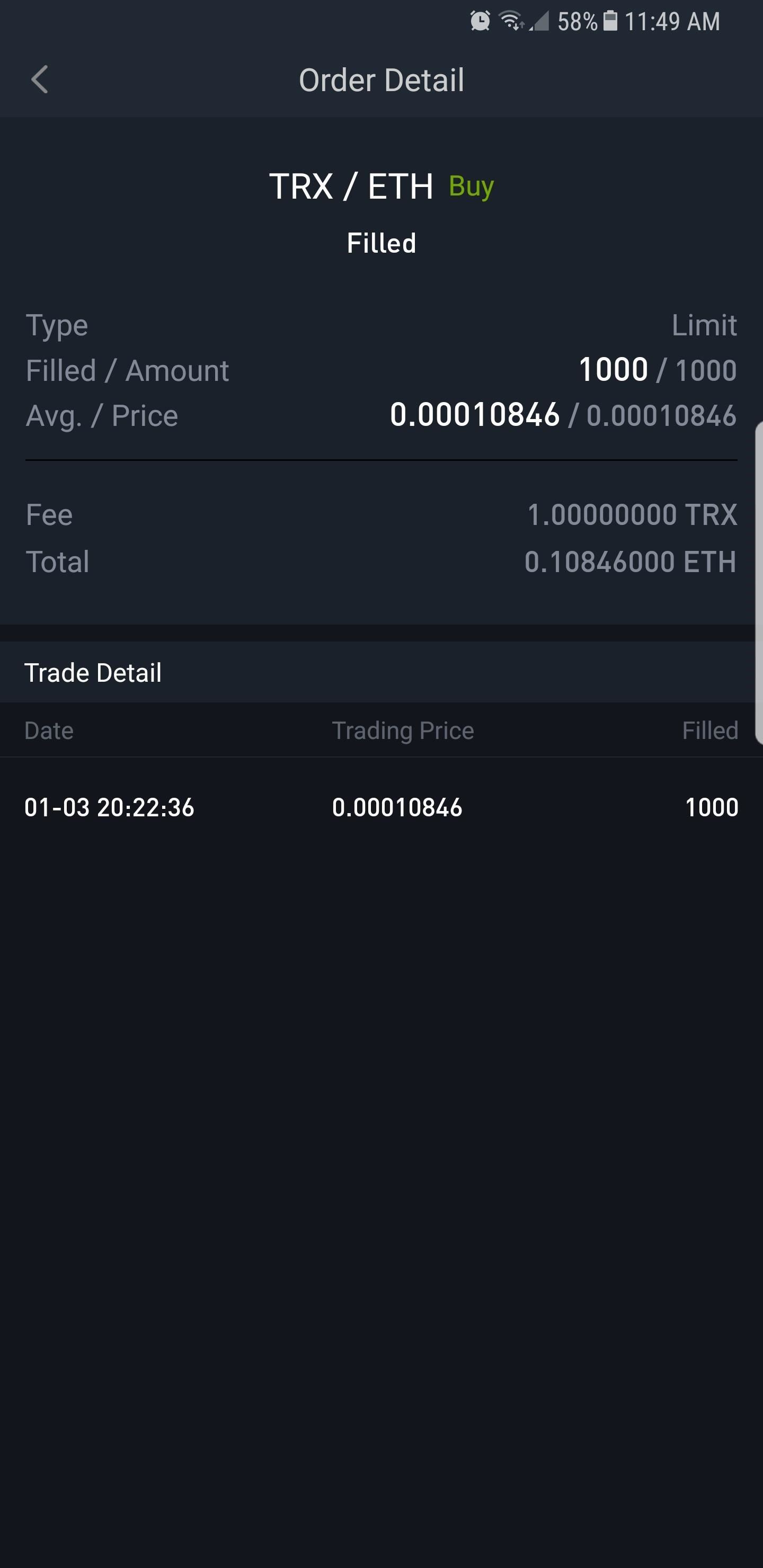

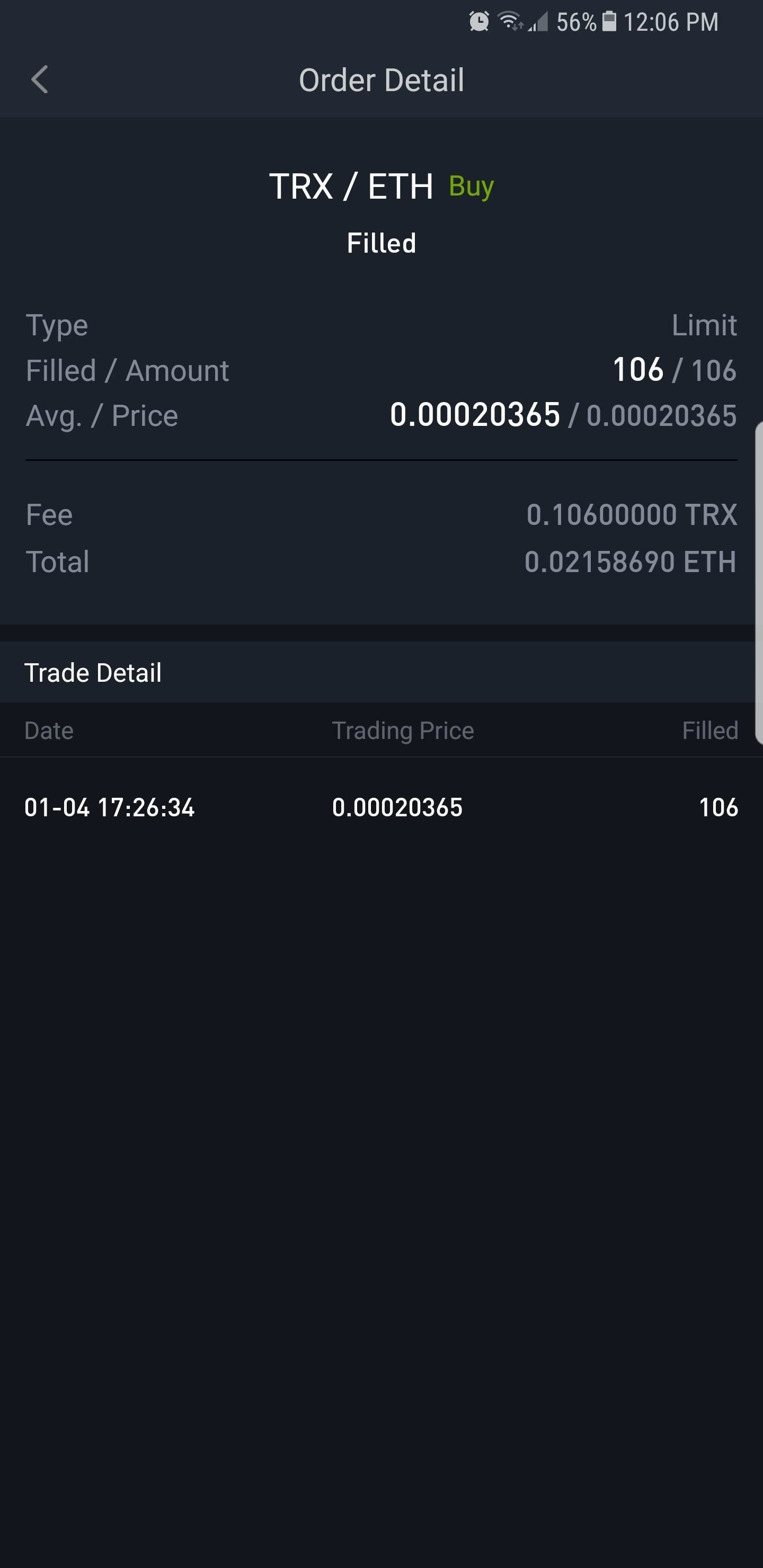

There Are Fees for Trading

Binance charges a flat 0.1% fee for executing trades on their exchange, regardless of whether you're buying or selling and using limit or market orders for transactions. The flat fee is applied automatically once a buy or sell order is fulfilled, and is deducted from the end cryptocurrency.

For example, If you bought 1,000 TRX using ETH as the base currency, the 0.1% fee of 1 TRX will be applied and automatically deducted from your order, netting you 999 TRX. Conversely, if you sold all your XLM holdings for exactly 1 BTC, the 0.1% fee of 0.001 BTC will be applied and net you .999 BTC.

To show it in dollar terms, if you bought 10,000 TRX using BTC as the base currency with the going rate of $0.10 per TRX and $10,000 per BTC, you would pay 0.1 BTC ($1,000). Binance will then apply the 0.1% fee in TRX, which would come out to 10 TRX ($1.00), and net you 9,990 TRX ($999).

To turn the tables around, if you exchanged 10,000 TRX for BTC at the same going rate as above, you'd get 0.1 BTC ($1,000). The 0.1% fee would then be applied in BTC, which would come out to 0.0001 BTC ($1.00), netting you 0.0999 BTC ($999). In essence, Binance's flat 0.1% fee means that you'll get charged 1 coin per 1,000, 10 per 10,000, 100 per 100,000, and so on, regardless of which currency you buy or sell.

There's a Discount on Trading Fees with BNB (Limited Time)

Binance currently offers a 50% discount on transaction fees, though the catch is you have to have enough of their digital coin — aptly named Binance Coin (BNB) — stored in your account to cover any fees. Basically, if you have enough BNB in your wallet, Binance will automatically shave 50% off their 0.1% fee on any trades you make, making it 0.05%. The fee will then be deducted off your BNB wallet. As Binance explains it:

You sell ETH on ETH/BTC and receive 1 BTC. Fees are calculated from the currency you're receiving at a rate of 0.1%, so you owe Binance 0.001 BTC.

From there, if you are opted in to paying fees with BNB, the 50% discount is applied (0.001 BTC -> 0.0005 BTC) and then the exchange rate applied.

If the exchange rate is roughly 150 BNB = 1 BTC, the fee would then be 0.075 BNB. If you have 0.075 or more BNB in your account, that's the fee you pay. Otherwise you pay 0.001 BTC.

You sell ETH on ETH/BTC and receive 1 BTC. Fees are calculated from the currency you're receiving at a rate of 0.1%, so you owe Binance 0.001 BTC.

From there, if you are opted in to paying fees with BNB, the 50% discount is applied (0.001 BTC -> 0.0005 BTC) and then the exchange rate applied.

If the exchange rate is roughly 150 BNB = 1 BTC, the fee would then be 0.075 BNB. If you have 0.075 or more BNB in your account, that's the fee you pay. Otherwise you pay 0.001 BTC.

The discount will also apply on your initial purchase of BNB, so if you buy 10 BNB with ETH and the and the current exchange rate is 100 BNB per ETH, the fee would be halved from 0.1 to 0.05 BNB. The discount decreases over time, however, and is cut by half every year for four years, then disappears entirely on the fifth year. It is also currently unknown how long Binance will offer the discount as new users stream in, so stay tuned as more concrete information surfaces regarding this matter.

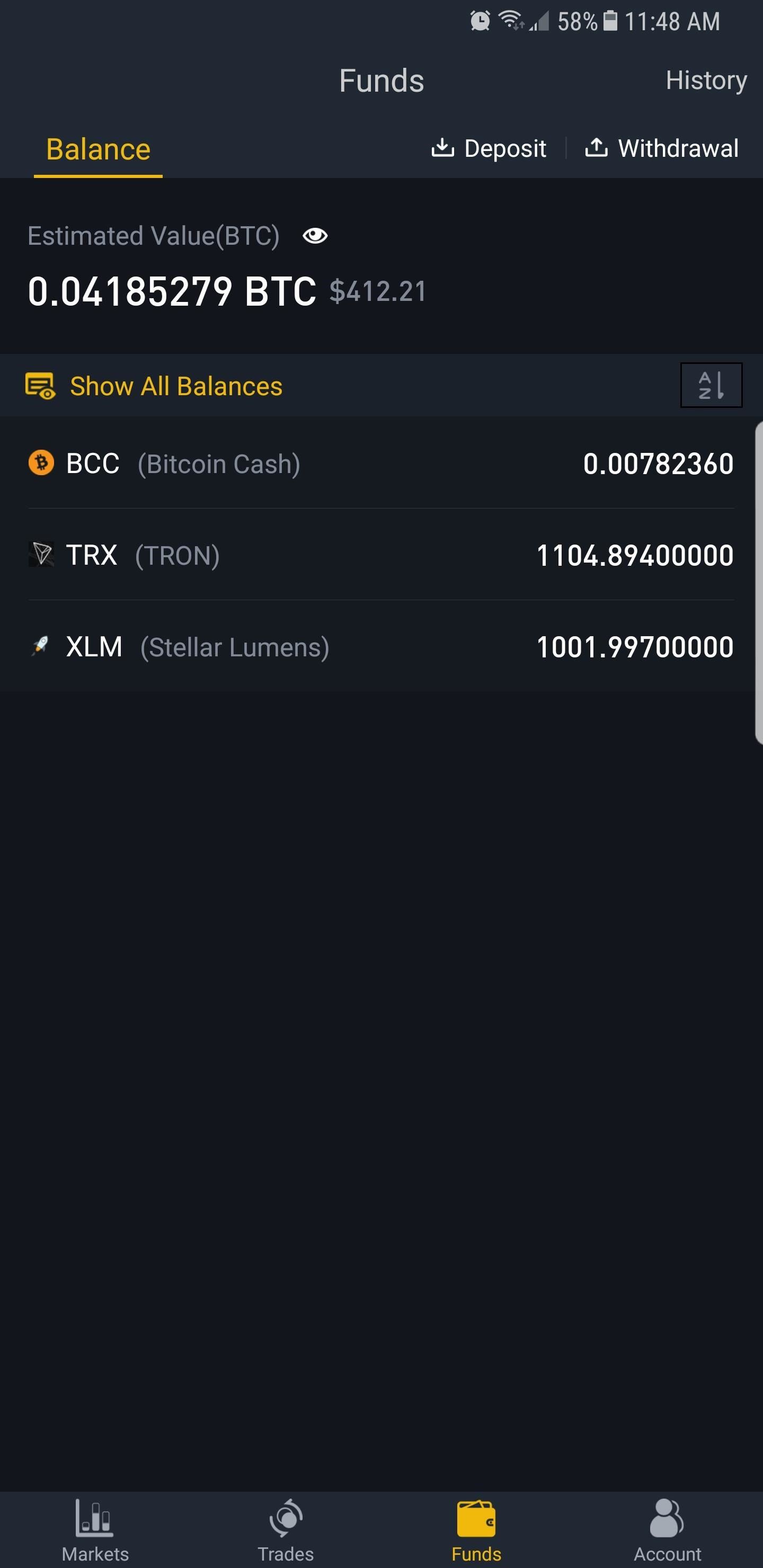

There Are Fees for Making Withdrawals

In addition to charging fees for executing cryptocurrency trades, Binance also charges a fee for making withdrawals out of their exchange, and there's a minimum amount that needs to be met or exceeded before Binance allows that transfer. Both the minimum amount and fees vary from coin to coin. As an example, here's the minimum withdrawal amounts and fees for the four major cryptocurrencies that you can transfer to Coinbase:

- Bitcoin: 0.002 BTC minimum withdrawal, transaction fee of 0.0005 BTC

- Bitcoin Cash: 0.002 BCC minimum withdrawal, a transaction fee of 0.001 BCC

- Ethereum: 0.1 ETCH minimum withdrawal, transaction fee of 0.01 ETH

- Litecoin: 0.02 minimum withdrawal, transaction fee of 0.01 LTC

It's worth noting that withdrawal fees are not set in stone and are subject to change due to blockchain conditions. We highly recommend you check out Binance's full list of available cryptocurrencies and their fees to stay up to date, as they can suddenly change due to network congestion or downtime. Thankfully, network fees associated with blockchain transfers are included in Binance's withdrawal fees, regardless of digital currency.

Regardless of cryptocurrency, withdrawal fees are automatically subtracted from your withdrawal amount once you finalize the transfer. For example, If you have 20 BTC in Binance and wish to withdraw 1 BTC at the going rate $10,000 per coin, Binance will apply the 0.0005 BTC fee ($0.50) to your 1 BTC withdrawal and won't touch the 19 BTC that's left in your exchange wallet, netting you exactly 0.9995 BTC ($9,999.50).

Keep in mind that minimum withdrawal amounts can be almost as low as the fees with some digital currencies (BCC and LTC, for example). With these coins, it's obviously not a good idea to withdraw the minimum amount, as the fee will eat up a significant chunk of your withdrawal. To put it into perspective, at the going rate of $1,000 per coin, the minimum withdrawal amount of 0.002 BCC would come out to $2. The withdrawal fee of 0.001 (equivalent to $1.00) would then be applied, effectively halving your withdrawal and netting you a paltry $1.

No Spending Limits, but There Are Withdrawal Limits

Binance doesn't place any limits on making deposits or executing trades on its exchange, though it does have a daily limit on the amount of cryptocurrency you can withdraw. For unverified users, Binance has a withdrawal limit equivalent to 2 BTC — $20,000, give or take a few thousand — which replenishes every 24 hours.

If you plan to do some high volume trading, you can increase your daily withdrawal limit to 100 BTC (at least $1 million) by submitting personal documents such as your social security and government-issued ID to verify your identity. To increase your withdrawal limits even further, you'll need to contact Binance.

You Need 2FA to Make Withdrawals

Though you can sign in, execute trades, and make deposits on Binance, you'll have to enable two-factor authentication (2FA) on your account before making withdrawals. While users from China have the option of receiving SMS-based authentication to get into their accounts securely, US residents have to rely on Google Authenticator to stay safe from hacks.

Linking your Binance account with Google Authenticator is a straightforward process — download the Google Authenticator app for iPhone or Android, enable it on Binance through your web browser and note the secret key that's provided, then add Binance to your Google Authenticator app. If you'd like a more thorough guide on this topic, be sure to check out the following link.

Transaction Times Are Fast, but Transfer Times Can Vary

While transaction times are extremely fast when executing trades on Binance, transfer times for deposits and withdrawals between Binance and your personal wallets can wildly vary from coin to coin. While lesser known alt-coins like XLM and EOS have snappy transaction times that take only seconds, seasoned coins such as BTC and ETH have been known to take up to five hours or more to transfer, due in large part to the sheer number of transactions being processed on their blockchain.

You Are Responsible if Your Account Gets Hacked

Like Coinbase, Binance places sole responsibility on its users when it comes to keeping their account and other important personal information secure, as evidenced by Section 2 of their User Agreement. This means you should use security measures such as strong passwords and two-factor authentication to keep cybercriminals out.

- Don't Miss: How to Create Stronger Passwords

Keeping your wallet as secure as possible can't be stressed enough, because once your bitcoins, bitcoin cash, litecoins, or ether are gone, your chances of getting them back are almost zero. To back this up, Binance doesn't currently offer any form of insurance policy to help cover any losses due to hacks and security breaches.

No Promises Regarding Overall Security

In addition to the current lack of insurance to help cover individual losses due to hacks, Binance makes no mention of safeguards and security measures that it may have in place to guard against potential breaches that can result in monetary loss or identity theft. The closest mention of any security protocols comes to us courtesy of Reddit, which is still pretty vague:

...Regarding security, Binance platform is engineered from the ground up with security, efficiency, speed and scalability taken into utmost consideration. The team has decades of combined experience building and maintaining a world class financial systems.

Binance Use Is Restricted in Some States

Unfortunately, not everyone in the US can technically use Binance to buy and sell digital currencies. Both New York and Washington states have laws that tightly regulate cryptocurrency exchanges. As a result, several popular exchanges such as Poloniex and Kraken have placed a ban on users with IP addresses that originate from these states.

Despite these prohibitions, however, several users from New York and Washington state report being able to trade cryptocurrencies just fine using Binance. This means the popular exhcange has yet to impose an IP address ban for these two states, and as long as residents stay under the radar by not verifying their residences, they should be able to continue to do so.

That said, we highly recommend that you transfer all your cryptocurrency holdings to a secure, personal wallet as soon as possible if you live in either NY or WA. Because cryptocurrency trading on a non-compliant exchange is illegal in those states, Binance might ban your IP Address at any time, which could result in losing all or part of your funds.

Cryptocurrency Is Subject to Capital Gains Taxes

Back in March 2014, the IRS declared cryptocurrency as property rather than currency. This clear definition — one that made cryptocurrency akin to stocks and real estate — made bitcoins and alt-coins subject to capital gains taxes.

These taxes vary in rates, and primarily depend on how long you hold a virtual currency. For instance, if you bought BTC for $10,000 and sold it for $30,000 in less than a year, then you are subject to short-term capital gains for the $20,000 you made and owe the government up to 37% — a whopping $7,400 — in taxes.

If that same transaction happens at least a year or more after your initial purchase, long-term capital gains will then apply and can range between 15% to 20%. So if you profited $20,000 in a span of at least a year from your initial $10,000 BTC purchase, then you'll need to pay the government around $3,000–4,000 in taxes, depending on your income and marital status.

In addition to this, the GOP tax reform bill has closed a loophole that previously let you freely exchange cryptocurrencies — such as buying ETH with BTC — without the fear of being taxed. This is a significant development if you trade cryptocurrencies, as all digital currency transactions can now be taxed by the government. How individual trades will be taxed, however, remain unclear. As such, we'll update this section as a clearer picture emerges regarding this matter.

Binance Can Suspend New User Registrations

With the addition of an astounding 240,000 new users in a single day, it comes as no surprise that Binance has struggled to keep pace with demand. As new users were flooding in, Binance temporarily suspended new user registration to help with server demand.

While Binance has since reopened at the time of this writing, it's only on a limited basis. So if you have trouble registering a new account, we recommend trying once a day, as the site will only let an undisclosed amount of new users in on a day to day basis until it's back to running at peak efficiency. We'll be sure to keep you posted as congestion eases, so check back regularly to stay up to date.

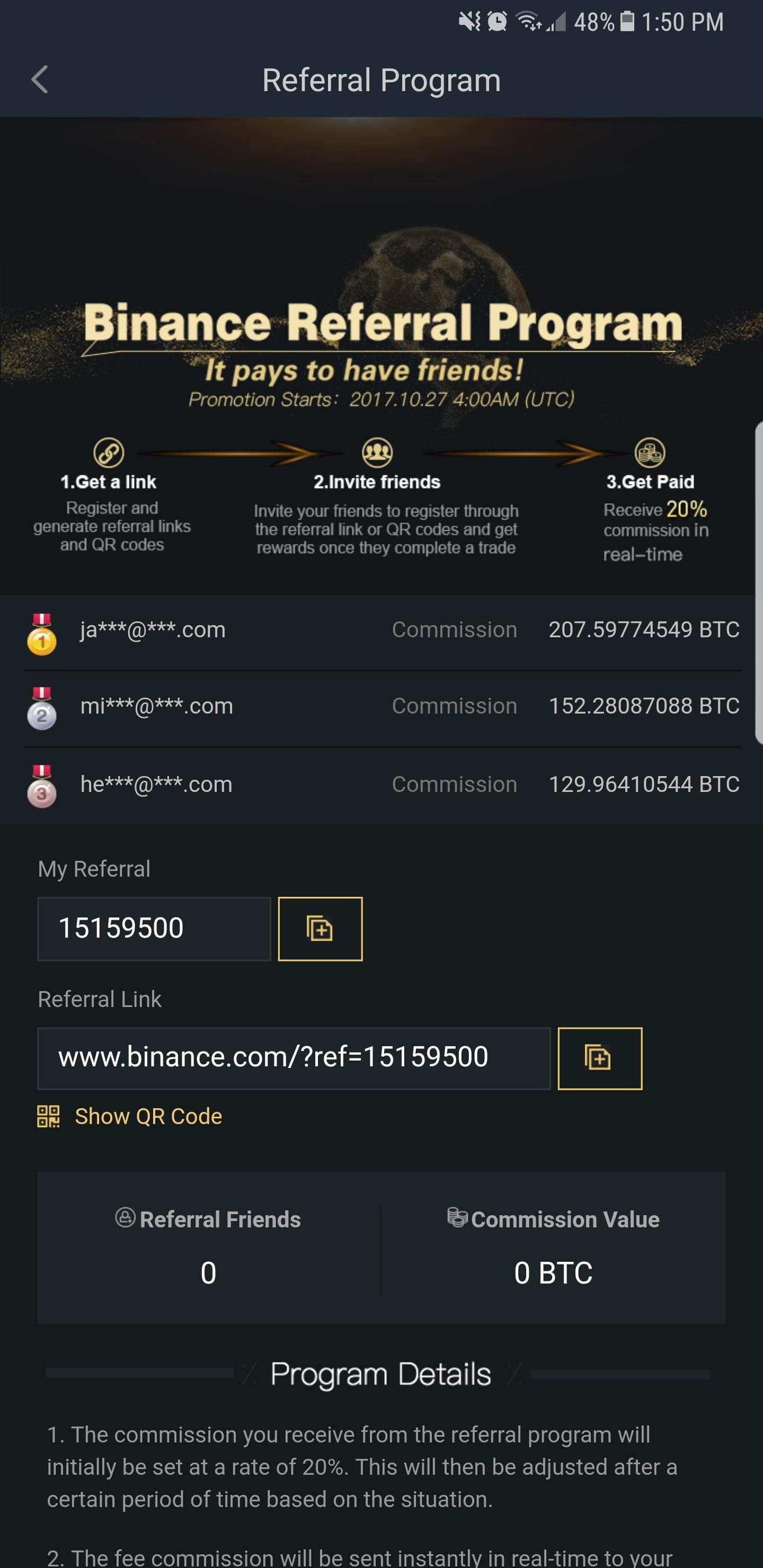

Binance Pays You for Referring Friends & Family

Binance has a referral program that rewards you with 50% of your referral's trading fees as commission for the first month of his or her trading. To refer a friend or loved one, either share your referral ID code (which can be found in the Account tab in your Binance app), or have them scan the QR code in Account –> Referral Program using their smartphone before they register and start trading.

Bear in mind, however, that some users have reported running into some issues on Binance regarding their referral commissions, so make sure to stay on top of your earnings. Don't hesitate to contact Binance if you encounter some discrepancies with regards to your commissions — you did earn them, after all.

Just updated your iPhone? You'll find new emoji, enhanced security, podcast transcripts, Apple Cash virtual numbers, and other useful features. There are even new additions hidden within Safari. Find out what's new and changed on your iPhone with the iOS 17.4 update.

2 Comments

Good article but 0.0005 x 10,000 = $5 fee and NOT $0.50...

which leave us with $9,995

"1 BTC at the going rate $10,000 per coin, Binance will apply the 0.0005 BTC fee ($0.50) to your 1 BTC withdrawal and won't touch the 19 BTC that's left in your exchange wallet, netting you exactly 0.9995 BTC ($9,999.50)."

Thats way more then that... on spot trading... if you buy or sell it can go 0.075 multiple times... even if u just have 100£.... making way more then 0.075(if u have bnb) per trade. They call that partially filled... and if you say nothing... they will b partially filled all the time... because they think your stupid. I just had one that i spent 300£ and got charged with the so said (partially filled) 3 times... so 3x0.0075% = 0.225% on a 300£ trade. So the 0.0005btc fee that equals 0.50... nothing like that. However it should of follow the explanations on the fee scenes... as 0 to 50 u pay 0.0075% should of if they didnt use that so called partially filled...

Share Your Thoughts